SHARK TANK CAST

WHO ARE THE SHARKS & GUEST SHARKS?

The cast of ABC’s Shark Tank is a rotating group of investors, business experts, and self-made millionaires and billionaires. There is a core group of 6 sharks (Mark Cuban, Robert Herjavec, Barbara Corcoran, Lori Greiner, Daymond John, and Kevin O’Leary), 5 of which appear on any given episode of Shark Tank. From time to time the Shark Tank cast includes special guest investors.

DAYMOND JOHN

BARBARA CORCORAN

ROBERT HERJAVEC

MARK CUBAN

KEVIN O'LEARY

LORI GREINER

GUEST SHARKS

SHARK BIOS

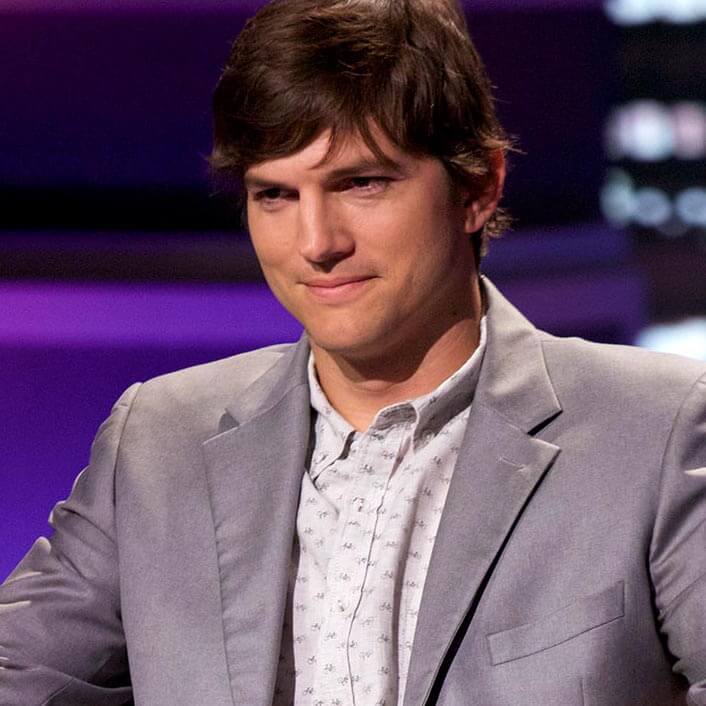

KEVIN O'LEARY

- Seasons 1 – Current

- AKA Mr. Wonderful

- Cast member of the Canadian series Dragons’ Den

- Founder of O’Leary Mortgages, O’Leary books, O’Shares Investments, O’Leary Ventures, O’Leary Funds Management, and O’Leary Fine Wines

- Cofounded and sold The Learning Company to Mattel for $4.2 Billion

Kevin O’Leary was born in Montreal, Quebec Canada. Learning much from his mother, Kevin began investing his money in high school and took an active interest in how to manage funds properly. His mother taught him to only spend the dividends of his investment and never the principal. That was a lesson that stuck with him for the rest of his life.

O’Leary’s life was forever changed by his very first job at an Ice Cream Parlor when his boss demanded that he scrape gum off the floor. His response was simply, “No” and so he was fired. He vowed then and there to be self-employed for the rest of his life. That moment moved him to attend university despite wanting to be a photographer, and he eventually went on to earn an MBA in entrepreneurship from the Ivey Business School at The University of Western Ontario.

During his time at University, O’Leary took a summer placement job with Nabisco in downtown Toronto. He worked with the company as an assistant brand manager, marketing their cat food after his internship, and was in charge of increasing the brand’s market share.

After his time with Nabisco, he went on to work as a television producer. Shortly thereafter, he founded Special Event Television (SET) and enjoyed moderate success with this venture. One of his partners later bought out his stake in the company for $25,000.

Next O’Leary decided to launch another successful venture, Softkey, a repackager of high-end business software for the consumer market. He secured an investor for $250,000, who later backed out before signing paperwork, and he was ultimately left to find funding elsewhere. Taking the $25,000 he had earned from his sale of SET, O’Leary was able to secure an additional $10,000 from his mother. To get distribution for the software, O’Leary approached printer manufacturers pitching a bundle with their software. It worked. By 1994, Softkey was a billion dollar consolidator in the educational software market, and acquired more than 60 rival companies. Softkey had wiped out the competition thanks to O’Leary’s often unpleasant and fanatical approach to business. Two years later in 1996 Softkey acquired The Learning Company (TLC) for $606 million and took its name. The company was eventually sold by O’Leary for a whopping $4.2 billion to Mattel in 1999. In 2008 he co-founded O’Leary Funds Inc. (a mutual and investment fund management firm that handles over $1.5 billion) with his brother and company director Shane O’Leary. He has built companies bearing his name in a number of other industries including O’Leary Ventures, O’Leary Mortgages, O’Leary books, and O’Leary Fine Wines.

O’Leary has also dabbled in writing and journalism, and released his first book in 2011 entitled Cold Hard Truth: On Business, Money & Life. He followed up that book with Cold Hard Truth On Men, Women, and Money: 50 Common Money Mistakes and How to Fix Them, and Cold Hard Truth on Family, Kids and Money.

O’Leary has appeared on numerous television shows both on and off camera. His resume includes SqueezePlay on the Business News Network, Discovery Project Earth, Dragon’s Den, and of course Shark Tank.

Tenacious, determined, and highly skilled in business, O’Leary will undoubtedly go down as one of the savviest business entrepreneurs of the 21st century.

LORI GREINER

- Seasons 3 – Current

- Known as “The Queen of QVC”

- Has created more than 600 products

- Holds over 120 U.S. and foreign patents

- Host of “Clever and Unique Creations by Lori Greiner”

- Founder of the For Your Ease Only (product development and marketing)

The key to Lori’s success is her ability to problem solve for the masses, creating affordable products that improve people’s lives. Known as the QVC Queen, Lori’s passionate entrepreneurism has won her a huge following, along with wide recognition for her achievements.

Reining from Chicago, Lori majored in Communications at Loyola University Chicago, with a focus on journalism, television and film. Lori was working at The Chicago Tribune before she acted on her inspiration to produce an earring holder, taking out a $300,000 loan and hustling to get it into J.C. Penny Stores in time for the holiday season. Within her first year of business, Lori’s company For Your Ease Only Inc. had made over $1 million in sales and she hasn’t slowed down since, now with a net worth of over $100 million. Lori is the CEO, working with the support of her husband Dan beside her, managing product development and marketing for her extensive range of inventions.

Driven by an enthusiasm for problem solving, both in her own life and those of her customers, Lori’s products can be found in the homes of millions, including celebrities like Oprah Winfrey, Heidi Klum and Joan Rivers. During her 16 year run on QVC, Lori has had a 90% success rate with the products featured on Clever and Unique Creations by Lori Greiner. From kitchen tools to travel bags, Lori’s product range answers to a diversity of needs and she has a keen instinct for a product’s potential for success.

Known as the warm-blooded shark on Shark Tank, Lori values opportunities to give back to the entrepreneurial community, being generous with her offerings of advice. Lori hit the bestsellers list with her first book Invent It, Sell It, Bank It!: Make Your Million-Dollar Idea into a Reality, a hands-on step-by-step guide on how to turn an idea into a million dollar reality. Lori’s product line is regularly featured in Town & Country, O The Oprah Magazine, Woman’s Day, Family Circle and InStyle. She has also been profiled in The Financial Times and Success for her outstanding entrepreneurial achievement.

MARK CUBAN

- Seasons 2 – Current

- Founded and sold MicroSolutions to CompuServe for $6 million

- Cofounded and sold Broadcast.com to Yahoo! for $5.7 billion

- Owner of Landmark Theatres and Magnolia Pictures

- Co-founder of AXS TV

- Majority Owner of Dallas Mavericks

- Founder of the Fallen Patriot Fund

Cuban’s entrepreneurial spirit was cultivated in middle school and high school when he sold sets of trash bags to fellow students to make money to buy a pair of shoes he desperately wanted. He also sold coins and stamps throughout school and made a name for himself as salesmen before he ever graduated from high school.

After high school, he went on to enroll at Indiana University. During his college years, he purchased and managed the most popular bar in the city. However, after the bar was shut down he moved to Dallas to pursue bigger and better things. Although he initially took a spot as a bartender, he later launched a company called MicroSolutions and sold it in 1990 for $6 million. He cleared roughly $2 million after taxes, but saved another $1 million to pursue additional interests down the line.

At the ripe age of 30, Cuban took the $3 million in his bank account and purchased a $125,000 lifetime pass on American Airlines, and was flying first class anywhere he wanted to. Despite his near ‘’rock star” status, Cuban was still making moves for his future. He started working for a hedge fund and ended up selling it with a partner for $20 million.

In 1995, Cuban and longtime friend Todd Wagner developed a powerful business idea to stream audio over the internet. At the time, it was known as Broadcast.com. Over the next four years, they developed the company and created a significant audience for their services. They eventually sold the company to Yahoo for a record $5.6 billion dollars. Cuban had become a billionaire by the age of 37.

Five years after reaching billionaire status, Cuban took a dramatic turn in his investment portfolio. In 2000, he purchased a majority stake in the Dallas Mavericks. The purchase set him back $285 million, but it might have been his biggest and best investment ever. Forbes reports that the Dallas Mavericks are the fifth most valuable sports franchise in the NBA, worth over $685 million.

Today, Mark Cuban is married with three children and continues to make major strides within the business and entertainment world. His appearance on the hit reality series “Shark Tank” has catapulted his popularity and brought his magnetic personality to the masses. His work as an entrepreneur and business investor is undisputed, and at not even 60 years old, he is far from done.

Mark Cuban shares his wealth of experience and business savvy in his first published book, How to Win at the Sport of Business: If I Can Do It, You Can Do It.

DAYMOND JOHN

- Seasons 1 – Current

- Founder of FUBU apparel company

- CEO and founder of The Shark Group

- Brandweek Marketer of the Year (1999)

- NAACP Entrepreneurs of the Year Award (1999)

- Crain’s Business Forty Under Forty Award (2002)

- Ernst & Young’s New York Entrepreneur of the Year Award (2003)

- Appointed by President Obama as an ambassador to promote underserved entrepreneurs (2015)

Daymond’s creative vision, commitment and sewing skills got the most iconic fashion brand in recent years off the ground from his mother’s remortgaged house in Hollis, Queens. FUBU, standing for “For Us By Us,” tapped into a market that had previously been neglected and paved the way for Daymond’s total innovation of branding strategy. Sharing his neighborhood with Hip Hop artists like RUN DMC and Salt-N-Peppa, FUBU became a synonymous with the emerging music culture that had a dedicated and growing community. When Daymond succeeded in getting various rappers, including superstar LL Cool J, to wear his T-Shirts on their music videos, popularity for his brand soared. He was still waiting tables while building the company for several years, sewing much of the merchandise himself. He recruited a couple of friends and then eventually some seamstresses, who came to work in his mother’s house as sales started to climb.

Drive and improvisation have gotten Daymond through one learning curve after another. The journey from sewing hats in his kitchen to being listed #15 on Details magazine’s list of “50 Most Influential Men” has earned him some valuable lessons. From mastering manufacturing to developing the perfect partnerships, to building and maintaining brand legitimacy, Daymond has become a master strategist. He soon recognized that the only way to fill the gaps in his knowledge was to partner with someone who already knew what he needed to know. When he signed a deal with Samsung America for global distribution, FUBU reached annual sales of $350 million, on a par with Donna Karan New York and Tommy Hilfiger.

Daymond now uses his branding expertise to build new companies through strategic relationships with icons in pop culture. As author of Display of Power: How FUBU Changed A World Of Fashion, The Power of Broke: How Empty Pockets, a Tight Budget, and a Hunger for Success Can Become Your Greatest Competitive Advantage, and The Brand Within: How We Brand Ourselves, From Birth To The Boardroom, Daymond continues to share his wisdom on the power of relationships in building brand success.

BARBARA CORCORAN

- Seasons 1 – Current

- Cofounded and sold The Corcoran Group (real estate) for $66 million

- Founder of The Corcoran Report

- Public Speaker and Author

- Contributor to The Today Show on NBC

Corcoran was born on March 10th 1949 in Edgewater, New Jersey. The second oldest of 10 children, she was immediately in competition from day one. Her mother was a homemaker and her father was a printing press foreman. She grew up learning the value of a hard work ethic, although Barbara struggled through school, barely managing to pull D’s in most of her classes. She eventually graduated from high school and enrolled at St. Thomas Aquinas College, graduating in 1971.

Once she completed her education she become a teacher, but only stuck with it for one year. Throughout her life, Corcoran has held twenty-two jobs. She credits her work as a waitress at a diner for helping her become the business mogul she is today. During one of her shifts she met a man made Ray Simone, a New Jersey based home builder. The duo started dating and shortly thereafter, she borrowed $1,000 from him to launch her own apartment rental company. However, it wasn’t long before their relationship dissolved.

Simone funded that initial investment of $1,000, but it was Corcoran who helped the company expand. After showing an apartment to a Union Carbide engineer who decided to purchase it rather than rent, Corcoran realized the potential within sales. She posted an ad for a sales agent the following day setting into motion her career in real estate. Within just two years, the Corcoran-Simone company was generating over a half million dollars in sales.

It took several years for the company to dissolve but according to Corcoran, Simone said she would never succeed without him, which further fueled her desire to make a name for herself. They divided the company in 1978 and she founded the Corcoran Group, the first female-run real estate company. The company earned over $350,000 in its first year.

Fast forward to 2001 when Corcoran decided it was time to sell the company. She had shifted her focus to family matters, after trying to get pregnant for over eight years and eventually giving birth to her son, Tommy. With negotiations on the table and an annual revenue of $100 million, and realizing she was the top broker in New York City, she told her attorney to find a buyer for $66 million—her lucky number. She sold the company to NRT Inc. within just a few short days.

After exiting the New York City real estate market, Corcoran wanted to get in front of the public in a fresh way. She decided to co-author a book, became a short-lived Fox consultant, and then went on to join the cast of Shark Tank. Her investments and public appearances have helped her multiply her millions and have given her a prominent place among business leaders.

You can learn from Barbara’s vast business experience in her books, Shark Tales: How I Turned $1,000 into a Billion Dollar Business, and Use What You’ve Got, and Other Business Lessons I Learned from My Mom.

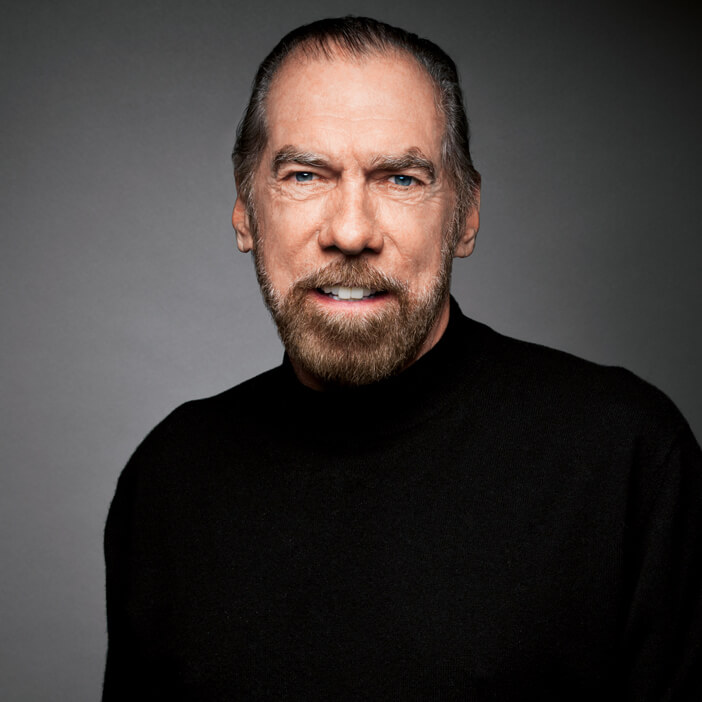

ROBERT HERJAVEC

- Seasons 1 – Current

- Cast member of the Canadian series Dragons’ Den

- Founded and sold BRAK Systems to AT&T Canada for $30.2 million

- CEO and founder of Herjavec Group (IT Security)

- Ernst & Young, Entrepreneur of the Year Award (2012)

- Sold RAMP Networks to Nokia for $225 million

It was in Canada that Robert learned his early lessons in the working world, as an immigrant from the farmlands of Croatia discovering what it meant to be poor in an alien economic landscape. He quickly learned to make ends meet as a newspaper deliveryman and a waiter, picking up valuable lessons in relating to his customers, maximizing his tips and turnover.

Before his foray into entrepreneurship, he experienced a variety of industries including working in retail, in film production as an assistant director and even as a collection agent. Adaptability is a trait that Robert emphasizes as key to success for an entrepreneur.

Robert’s entry into the tech industry involved him convincing Logiquest, a computer start-up, to let him work there for free. He was under qualified for the position selling IBM mainframe emulation boards, but after 6 months he earned himself a paycheck and went on to become the General Manager. He was eventually fired from the company, which gave him the push to start his own company to keep up with his mortgage payments.

Robert says he’d never thought of becoming an entrepreneur, yet after starting BRAK Systems in his basement, it soon became Canada’s top provider of Internet Security Software, before being sold to AT&T Canada. Within couple of years Robert managed to sell RAMP Networks, another technology company, to Nokia for $225 million.

Robert attributes his success to working in a field that he’s passionate and knowledgeable about. After taking three years retirement to spend time with his family, he started his best business yet, The Herjavec Group. It’s an IT integrator that does computer security and information storage for enterprise and government. He says its like a mini IBM. The Herjavec Group has become the fastest growing Canadian security company to date, earning tens of millions of dollars in revenue every year.

Aside from technology, Robert has a love of racing cars, achieving multiple podiums in the Ferrari Challenge North America Series.

In response to the question of what he would differently if he had to do it all again, Robert says he would have dreamed bigger.

JASON BLUM

- Season 15

- Founder and CEO of Blumhouse Productions

- Pioneered a unique micro-budget film production model

- Films produced have grossed over $1.2 billion worldwide

- Multiple Academy Award nominations for Best Picture

- Produced over 75 films and TV series

- Former co-head of the Acquisitions and Co-Productions department at Miramax Films

Under the first-look deal with Universal Pictures, the company created major franchises such as The Purge and Insidious, which helped redefine the horror genre. The financial metrics are staggering: The films have garnered a combined worldwide gross of over $1.2 billion, all on a cumulative budget of less than $40 million. The lean budgets allow for creative freedom, a cornerstone of the company’s philosophy.

Jason Blum has not only made waves in the world of cinema but also has a considerable footprint in the television industry. He claimed an Emmy Award for producing The Normal Heart on HBO, a poignant drama film that spotlighted the early years of the HIV/AIDS crisis in New York City. Blumhouse also produced other TV series such as Ascension on Syfy and Eye Candy on MTV. Moreover, Blum won another Emmy for the documentary miniseries The Jinx, adding more feathers to his already decorated cap.

The production mogul cut his teeth in the industry by serving as the co-head of Acquisitions and Co-Productions at Miramax Films. During his stint, he played a key role in acquiring over 50 films, including noteworthy titles like The Others and A Walk On the Moon. Before his corporate foray, he was the producing director of the Malaparte theater company, founded by actor Ethan Hawke, signaling his early passion for storytelling and drama.

Born in Los Angeles, California, to Shirley Neilsen Blum, an art professor, and Irving Blum, an independent art dealer, Jason grew up in an environment that fostered creativity. After graduating from Vassar College in 1991, he took his first steps in film production with Kicking and Screaming, produced for his then-roommate and future filmmaker Noah Baumbach.

Blum’s impact is felt beyond the screens and sound stages. He’s also known for his philanthropic efforts, highlighted by a remarkable $10 million donation to his alma mater, Vassar College. Moreover, he holds seats on several prestigious boards, including The Public Theater in New York and the Sundance Institute, indicating a broader influence on arts and culture.

With his unconventional approach to filmmaking and a keen eye for stories that captivate audiences, Jason Blum has emerged as a force to be reckoned with in Hollywood. His success continues to be a subject of study and admiration for aspiring producers and filmmakers alike.

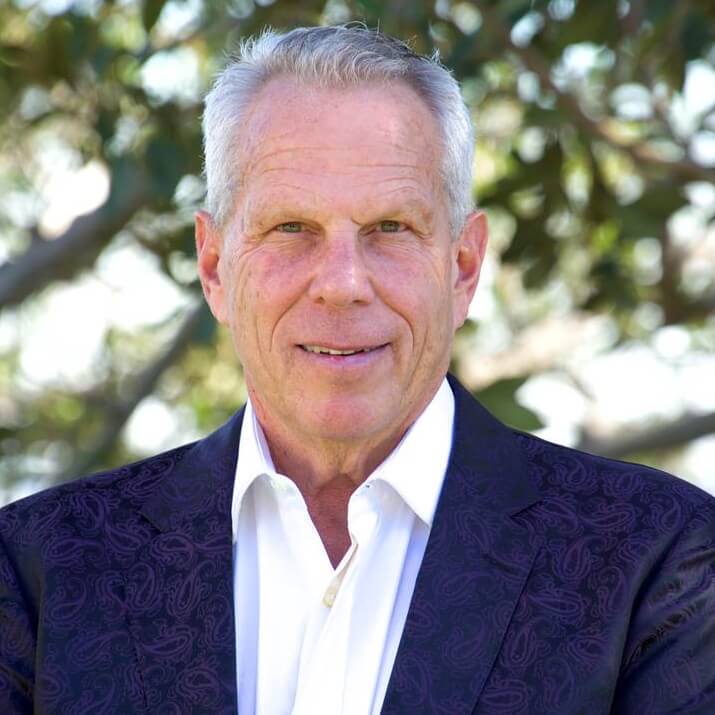

MICHAEL RUBIN

- Season 15

- CEO of Fanatics, a leader in licensed sports merchandise

- Executive Chairman of Rue Gilt Groupe

- Founder of GSI Commerce, sold for $2.4 billion to eBay in 2011

- Former partner in the Philadelphia 76ers and New Jersey Devils

- Co-chair of REFORM Alliance, a criminal justice reform organization

- Forbes 400, World’s Billionaires, Bloomberg Billionaires Index

His early life reflects an entrepreneurial spirit that has been a constant in his journey. Born to a Jewish family in Lafayette Hill, Pennsylvania, Rubin’s mother was a psychiatrist and his father was a veterinarian. Rubin’s venture into business began in his own basement at the age of 12 when he started a ski-tuning shop. Utilizing the seed capital he acquired from bar mitzvah gifts and a loan from his father, he opened a formal ski shop called Mike’s Ski and Sport in Conshohocken, Pennsylvania. By the time he was 16, his business had grown to five ski shops, but not without accumulating significant debt. Through a loan from his father, he managed to settle with creditors and began attending Villanova University, only to drop out after a single semester.

His interest in e-commerce was apparent from his early years. After selling his ski shops, Rubin founded KPR Sports, an athletic equipment closeout company. The company would hit the milestone of $1 million in annual sales by the time Rubin was 21 and went on to reach $50 million in sales by 1995. His business acumen became even more pronounced when he founded Global Sports Incorporated in 1998, which would later evolve into GSI Commerce, a titan in e-commerce that he would sell to eBay for a hefty $2.4 billion in 2011.

Aside from e-commerce, Rubin’s portfolio also extends to the sporting world. He was a partner in the Philadelphia 76ers basketball team and the New Jersey Devils hockey team until June 2022 when he sold his stakes to focus on Fanatics. His influence in the world of sports doesn’t end there; Rubin is also the co-chair of the REFORM Alliance, a criminal justice reform organization he co-founded in January 2019, along with notable names like Jay-Z, Meek Mill, and Robert Kraft.

Rubin’s philanthropic ventures include the REFORM Alliance and the viral “All In Challenge,” which raised over $60 million to combat food insecurity during the COVID-19 pandemic. His influence extends to media appearances, having been featured in publications like The Wall Street Journal, The New York Times, and Sports Illustrated, as well as on shows like Good Morning America and Dateline NBC.

In personal life, Rubin is a divorced father of two daughters. He divides his time between the Philadelphia area, close to his roots, and New York City, where he purchased a $43.5 million penthouse in 2018. The businessman also has a taste for lavish social events, hosting an annual “white party” at his estate in The Hamptons for Independence Day, frequented by celebrities like Jay-Z and Beyoncé, Justin Bieber, and Tom Brady.

Rubin’s career exemplifies a mix of business acumen, dedication to social causes, and a knack for seizing market opportunities. As of September 2021, he secured funding that brought Fanatics’ valuation to $18 billion, setting the stage for the company to expand into new sports verticals and develop a global digital sports platform. Whether it’s his early ventures in ski equipment, his giant strides in e-commerce, or his innovative approaches in sports merchandising, Rubin’s journey maps the road taken by a dynamic and diversified entrepreneur.

CANDACE NELSON

- Season 15

- Co-founded Sprinkles Cupcakes bakery

- Introduced the concept of the Cupcake ATM cupcake delivery system

- Co-founded Pizzana, an award-winning Neo-Neapolitan pizza chain

- Served as a judge on over 100 episodes of Food Network’s “Cupcake Wars”

- CN2 Ventures, a family office investing in early-stage consumer companies

Starting her career in the cutthroat world of investment banking along with her husband, Charles Nelson, Candace shifted her focus to the culinary arts following the dot-com bubble burst. Working out of her home in San Francisco, she initially started with a custom cake business. It wasn’t long before the couple moved their burgeoning venture to Los Angeles, and chose to specialize in cupcakes exclusively.

The journey of Sprinkles began in 2005, when the Nelsons opened their first store in a small, 600-square-foot space in Beverly Hills. Despite the bakery industry experiencing a period of low interest in carb-rich foods, the Nelsons saw instant success, selling 2,000 cupcakes in their first week. This feat is often attributed to Candace’s unique approach to cupcake making. She focuses on quality, opting for high-end ingredients like sweet cream butter, Callebaut chocolate, and Nielsen-Massey Madagascar Bourbon vanilla. In addition to traditional cupcakes, the menu also includes unconventional options like gluten-free and vegan cupcakes, and even cupcakes designed for canine consumption.

Not just the menu, even the physical appearance of the store reflects a meticulous attention to detail. An Austrian architect was responsible for the sleek, minimalistic design of the original store, and a former employee of Martha Stewart helped with the logo and packaging. Over the years, the Sprinkles brand expanded to 22 locations across the United States, including New York, and has future plans to enter markets in London and Tokyo. Beyond physical stores, Sprinkles also introduced the concept of a “Cupcake ATM,” an innovative contactless delivery system, fulfilling a vision Candace had during a late-night pregnancy craving.

Beyond cupcakes, Candace expanded her gastronomic empire to include Pizzana, a chain specializing in Neo-Neapolitan pizzas. Pizzana has quickly gained traction, receiving several awards for its unique take on a traditional dish.

Candace’s influence also extends to the publishing and television sectors. She penned “The Sprinkles Baking Book,” which landed on the New York Times Best Seller list, and is a regular contributor to the Wall Street Journal. On the small screen, she has served as an executive producer and judge for Netflix’s show “Sugar Rush,” and also adjudicated on more than 100 episodes of Food Network’s “Cupcake Wars.” Her upcoming project “Best in Dough,” a pizza cooking competition, is set to premiere on Hulu, where she serves as co-creator and executive producer.

Her venture interests are housed under CN2 Ventures, a family office that invests in early-stage consumer companies, further diversifying her business activities.

Candace Nelson has also made several television appearances, including on “The Today Show,” “Nightline,” “The Martha Stewart Show,” and “Masterchef Season 10.” Her work has been profiled in publications like People magazine, and her cupcakes have been praised by media outlets such as Bon Appetit magazine, Food & Wine, The New York Times, and the Los Angeles Times.

TONY XU

- Season 14

- Graduated from Stanford University’s School of Business as an Arjay Miller Scholar

- Co-founder and CEO of DoorDash

- Became a billionaire at age 36 with DoorDash IPO

- DoorDash became the first official food delivery partner of the NBA

- Member of the Giving Pledge

Xun’s favorite TV shows were NBA games and Who’s the Boss? with Tony Danza. He credits basketball with helping him learn English and the sit-com with giving him his name. When he legally changed his name to something more familiar to Westerners, he chose Tony.

Tony went on to earn a BS degree in Industrial Engineering and Operations Research from the University of California, Berkeley, and graduated from Stanford University’s Graduate School of Business as an Arjay Miller Scholar. The award recognizes the academically highest 10 percent of the graduating MBA class.

While still a student, Tony gained valuable experience working for a number of high profile tech companies, including eBay and PayPal. In 2012, Tony and three classmates co-founded a delivery service, Palo Alto Delivery. They realized that the only food delivered in those days was pizza and Chinese. Why not deliver other food and help out smaller restaurants? The four friends took turns taking the orders, delivering the food and signing on new clients.

In 2013, they had to decide: Move on from Palo Alto Delivery and get “real jobs” or go all in on the business? As we know, they went all in and rebranded their delivery business as DoorDash, which is now the largest local logistics company in the US, servicing hundreds of thousands of merchants and tens of millions of consumers.

DoorDash’s initial public offering in 2020, led by Tony, made him a billionaire at the age of 36. That same year, he was selected for Fortune Magazine’s “40 Under 40” list of the most influential young leaders.

Among Tony’s investments are the blockchain technology provider Alchemy and “ghost kitchens,” All Day Kitchens and Local Kitchens. Ghost kitchens are anonymous locations where food is prepared solely to be delivered by DoorDash and other food delivery apps. For instance, you might order dinner from Hannibal’s Specialties, but don’t plan on visiting the restaurant. You’ll never find it.

Tony is still an avid basketball fan, and it feels like he came full circle when he negotiated a partnership in which DoorDash became the official on-demand delivery platform of the NBA, WNBA and NBS 2K League.

Tony and his wife Patty live in San Francisco with their two children. They have signed the Giving Pledge, a promise made by the world’s wealthiest individuals and families to donate the majority of their wealth to charitable causes. Tony and Patty have made significant donations to UC, Berkeley; Northwestern University; and Asian American and Pacific Islander (AAPI) organizations.

GWYNETH PALTROW

- Season 14

- Founder and CEO of Goop, a wildly successful modern lifestyle brand.

- Won an Oscar, a Screen Actors Guild Award, a Golden Globe, and a Primetime Emmy for acting.

- Recognized as an outstanding woman in entertainment by Women in Film Los Angeles.

- Authored several cookbooks.

In 2017, Gwyneth took a break from acting to concentrate on her business, Goop.* It was originally a database of information to share with friends, then became a weekly newsletter available to anyone who joins. It now has expanded to the goop.com website. Despite the many controversies generated by Goop (and sometimes because of them), it is worth $250 million and is one of the world’s most successful female-led lifestyle brands. Goop has launched pop-up shops, a wellness summit, a print magazine, and a podcast.

* Someone told Gwyneth that successful Internet companies have double Os in their names. So she put the two Os inside her initials and, therefore, Goop.

Cookbook Author

- Spain . . . A Culinary Road Trip with Mario Batali

- My Father’s Daughter: Delicious, Easy Recipes Celebrating Family and Togetherness

- Notes From the Kitchen Table.

- It’s All Good: Delicious Easy Recipes That Will Make You Look Good and Feel Great,

- It’s All Easy: Delicious Weekday Recipes for the Super-Busy Home Cook.

Savvy Investor

Gwyneth has been a very successful investor—from a wellness startup for women to real estate to MoonPay, Hollywood’s favorite crypto start-up. In 2020, she invested in Cann, drinkable cannabis, pronouncing cannabis the “hero ingredient of the future.” In 2021, she was an early investor in Thirteen Lune, an e-commerce site focused on skin care, hair care and health aid companies owned by people of color.

- Supporter of Charitable Causes

- Save the Children artist ambassador, raising awareness about World Pneumonia Day.

- On the board of the Robin Hood Foundation dedicated to alleviating poverty in New York City.

- Estée Lauder donates a minimum of $500,000 annually to breast cancer research from the sales of the Pleasures Gwyneth Paltrow Collection.

KEVIN HART

- Season 13

- Comedian, actor, producer, author, and entrepreneur

- Recipient of multiple BET Awards, Nickelodeon Kids Choice Awards, Teen Choice Awards, and People Choice Awards

- Founded Laugh Out Loud, a global media and production company, that includes LOL Network, LOL Studios, LOL Audio, and LOL X

- Established Help From the Hart Charity to support underserved communities

The acclaimed director and producer, Judd Apatow, gave Kevin his first break into acting, casting him in a television series that was short-lived, but it was the beginning of Kevin’s long acting career. He has appeared in more than 50 movies. Ten of his films were #1 at the box office and grossed $4.23 billion in revenue. In addition to films, Kevin has embarked on worldwide comedy tours, including his What Now? Tour that finished up in his beloved Philadelphia where a cheering audience of 53,000 welcomed him to the Lincoln Financial Field Stadium. Kevin is in demand as a master of ceremonies and has hosted the BET Awards, MTV Video Music Awards, MTV Movie Awards, and the Comedy Central Roast of Justin Bieber.

During the COVID-19 pandemic, Kevin’s Help From the Hart Charity provided meals to the elderly and others in need in Philadelphia—meals that were prepared by professional chefs and delivered hot. He also donates to Feeding America. In partnership with the United Negro College Fund, Kevin’s charity donated $600,000 to 11 Historically Black Colleges and Universities (HBCUs) for scholarships and operating expenses.

In his spare time (and who knows how he finds any), Kevin loves playing professional poker—and winning, which he does often.

NIRAV TOLIA

- Season 13

- Co-founder of Nextdoor, the world’s largest local social network

- Discovered the wonders of the Internet as a Dallas Cowboys fan living in San Francisco

- Learned how to run a business as manager of his a cappella group, Fleet Street Singers

- Hired on at newly founded Yahoo with little experience in computers

- Teaches at Stanford University in Florence, Italy, on Renaissance Florence and Silicon Valley

His parents were physicians who immigrated from India and instilled in Nirav that there were no limits to what he could do and where he could go. So when his classmates applied to nearby colleges, Nirav applied to Stanford in California. He was accepted and planned on following in his parents’ footsteps, until he realized he just could not stand hospitals. That was when he started adding English literature courses to his heavily science-related curriculum.

Nirav had used computers in high school, but was not all that interested. However, his dorm at Stanford had a high-speed Internet connection and he found Usenet—news groups that predated the Wide World Web. The San Francisco area can be a lonely place for a Cowboys fan, so finding fans across the country and around the world and communicating with them was an epiphany for him. He dearly missed the community spirit of Odessa and appreciated his new and widespread community of Cowboys fans.

He found another community in an a cappella group at Stanford, the Fleet Street Singers. When the business manager graduated, he stepped in—with no business experience—and did a great job. Through the group, he met the founders of Yahoo! People were not beating down the doors to join a company called Yahoo, so he was hired—regardless of his lack of experience.

He worked there for three years, then set out on his own, first co-founding Epinions, a community review site, that floundered during the dotcom crash, but eventually flourished and was sold to eBay for $620 million.

In 2010, Nirav co-founded Nextdoor. He wanted to create the community spirit of Odessa on the Internet. Nextdoor connects people in specific neighborhoods. They can report lost pets, find a baby sitter, borrow tools, sell items, post news, even have a virtual town meeting. They can do anything they could do in a close-knit community! It differs from Facebook, Twitter, etc. in that users must give their real names and addresses to be verified. Also, content cannot “go viral,” because it stays within the one community and is primarily only relevant to that community. That community spirit extended to Nextdoor partnering with the Centers for Disease Control and the American Red Cross to distribute local information about COVID and with Walmart to allow users to request shopping assistance during the pandemic. Nextdoor is in more than 275,000 neighborhoods in 11 countries. In the US, it is used by one out of three households.

Nirav and his wife, Megha, the VP of Strategy and Ecommerce at Method Products, realized that their three sons were growing fast. They didn’t want to miss out on the boys’ childhood years. They are now enjoying an extended sabbatical in Florence, Italy. In the Stanford University program in Florence, Nirav teaches Silicon Valley: The Modern Day Rebirth of Renaissance Florence, in which he compares Florence then and Silicon Valley today and the “intersections of technology, entrepreneurship, and humanism that enabled two relatively small valleys to rise up and change the world.”

PETER JONES

- Seasons 13 & 14

- British tycoon, serial entrepreneur, Commander of the Order of the British Empire, and reality television personality

- 19 seasons on the Dragons’ Den, the UK version of Shark Tank

- Established his first business when he was 16 years old—a tennis academy

- Went from penniless to $44 million in 36 months

When he was 16 years old, he had a real business to run—a tennis coaching academy. In his 20s, he made personal computers under his own brand and did very well for a while. But he hadn’t read the fine print on a contract with a major corporation and lost everything—business, house, cars. He went back to live with Mom and Dad poorer but wiser.

He went to work for a large corporation and, in a year’s time, he was running the UK side of the business. He was gaining business experience and growing his bank account, so that in two years he could start his own business, Phones International Group, one of the fastest growing businesses in Europe. In a mere 36 months, he went from broke to making $44 million a year.

In 2002, Peter was named Emerging Entrepreneur of the Year by Britain’s newspaper, The Times.

In 2005, Peter was one of the investors in the first episode of Dragons’ Den, the UK version of Shark Tank. He is the only original Dragon still on the show, now in its 19th season. He has invested £5,983,167 ($8,142,521) over the years.

He also produced his own reality show, American Inventor, in partnership with Simon Cowell and appeared as a judge.

In 2008, Peter became a Director of Biffa Waste Services Limited, the leading integrated waste management company in the UK. In that position, he has helped raise awareness of the significance of waste management concerns, in the media and in Parliament. He advises in matters related to carbon, global efficiency and climate change and has a leading role in the research that shapes the UK’s waste strategies.

In 2009, Peter was appointed Commander of the Order of the British Empire (CBE), an award surpassed only by being knighted. He was recognized for his contributions to business, entrepreneurship and young people. At the reception following the ceremony, Queen Elizabeth and Prince Philip joked with Peter about his socks. Yes, his socks!

Peter’s socks are his trademark. They are always brightly colored and striped. They have received so much attention that he launched The Peter Jones Collection of luxury socks that are natural, sustainable, biodegradable, super soft yet durable.

The Peter Jones Foundation helps young people in the UK by supporting the “Forgotten Children,” for instance, those with terminal illnesses and those living in abusive homes. Through the Peter Jones Enterprise Academy, young people learn through a combination of experience and skill development taught by real entrepreneurs to see their ideas through to commercial success.

EMMA GREDE

- Seasons 13 & 14

- Started her own marketing agency, ITB Worldwide, when she was 24 years old

- CEO and Co-Founder of Good American with Khloe Kardashian

- Founding Partner of SKIMS with Kim Kardashian

- Co-Founder of Safely, plant-based cleaning products, with Kris Jenner

- Member of the Women for Women International Board of Directors

Emma was never an enthusiastic student, but she was always a hard worker. She started working when she was 12 years old and has never stopped. She had an interest in and an eye for fashion, so attended The London College of Fashion, but dropped out to go to work for Inca Productions, a leading fashion show and event producer in Europe. From there, she founded ITB Worldwide and represented brands’ interests in the world of entertainment, e.g., Calvin Klein and H&M.

With Khloe Kardashian, Emma launched the denim brand, Good American, a premium label that offers an inclusive size range, from 00 to 32. It was the most spectacular apparel launch ever with sales of more than $1,000,000 the first day, clear evidence that Good American was filling a gaping hole in women’s fashions by catering to a curvier, fuller shape of woman rather than the angular bodies seen on traditional runways. Good American helped to change the way fashions are merchandised by requiring that their retail partners display all sizes together. No more size 2’s front and center and size 24’s shoved into a corner. The company also created a demand for plus-size models.

The Good American brand supports the charity Step Up that helps girls living in underserved communities become confident, college-bound, career-focused future professional women.

With Kim Kardashian, Emma founded the underwear, loungewear and shapewear brand SKIMS. SKIMS set new standards for providing innovative solutions for every body, from underwear that stretches to twice its size to shapewear that enhances curves.

With Safely, Emma and Kris Jenner’s mission is to rid homes of harsh chemical cleaning products. The plant-powered ingredients produce squeaky clean results on all surfaces efficiently, gently and fragrantly.

Emma is an active member of Women for Women International, an organization that serves women who are survivors of war and conflict by teaching them the skills they need to rebuild their families and communities. They learn to save, build businesses, improve their health, and change societal rules.

Emma also contributes to Baby2Baby’s mission to supply diapers, clothes and other necessities for children in homeless shelters, foster care, hospitals and underserved schools. During the COVID-19 pandemic, Baby2Baby served more than one million children across the country.

Emma supports Black-owned businesses and recently invested in BREAD BEAUTY SUPPLY, a haircare brand that is gaining in popularity in the curly hair community with products that care for the whole range of hairstyles, including curls, fuzz, frizzy bits, bangs, braids, and bantu.

BLAKE MYCOSKIE

- Season 12

- Founder TOMS Shoes

- Founder Social Entrepreneurship Fund

- Founder Madefor

- Secretary of State’s 2009 Award of Corporate Excellence

- 2015 Next Generation Award from Harvard’s School of Public Health

- 2016 Cannes Lion Heart Award

In 2014, after selling half of the company to Bain Capital, Mycoskie stepped down as CEO of TOMS. Utilizing half of his proceeds, he started the Social Entrepreneurship Fund to help early startups with core social missions get off the ground with much-needed funding. Since then, he has invested in over 25 social enterprises.

More recently, Mycoskie co-founded his newest company, Madefor. A 10-month program that applies the principles of modern neuroscience, psychology and physiology to make your brain and body better. Created alongside scientists from Stanford, Harvard and other top universities, Madefor helps people learn and sustain positive habits and practices that have the greatest impact on their lives.

Mycoskie has achieved numerous accolades for his unique approach to business including the Secretary of State’s 2009 Award of Corporate Excellence, the 2015 Next Generation Award from Harvard’s School of Public Health, the 2016 Cannes Lion Heart Award and the 2018 amfAR Award of Courage. Mycoskie has also been featured in People Magazine in the “Heroes Among Us” section and in Fortune Magazine’s “40 Under 40,” among others.

Mycoskie also recently expanded his philanthropic efforts to include the funding of the Center for Psychedelic and Consciousness Research at Johns Hopkins, making it the first such research center in the U.S. and the largest of its kind in the world.

Born and raised in Texas, Mycoskie now resides in Jackson, Wyoming, with his family, dogs and horses. In his free time, he can be found outside enjoying nature whether it is rock climbing, surfing or snowboarding.

KENDRA SCOTT

- Seasons 12 & 14

- EY Entrepreneur of the Year 2017 National Award

- Breakthrough Award from the Accessories Council Excellence Awards

- Listed by Forbes as one of America’s Richest Self-Made Women

- Texas Business Hall of Fame

- Board of directors Breast Cancer Research Foundation

Determined to maintain growth and preserve the vision of her business, Scott waited over 10 years to accept outside investments. She has since grown the company to a billion-dollar valuation with over 100 stores nationwide and a thriving e-commerce and wholesale business. According to a 2018 PitchBook study, Scott is among only 16 women in the United States to carry the title of founder of a company valued at $1 billion.

Today, Scott’s company continues to operate out of Austin, Texas, with their state-of-the-art corporate office complete with a design lab and an industry-leading distribution center, both catering to her employees’ career goals and family-life balance. With family and fashion as two core pillars of her business, Scott maintains a focus on her third core pillar of philanthropy in all she does.

Since 2010, the company has given back over $30 million to local, national and international causes. On a national level, Scott supports organizations that actively help women and children live their brightest, healthiest and most empowered lives. This comes to life through initiatives like the Kendra Cares program, where the brand brings its customizable Color Bar™ to pediatric hospitals across the country as a creative arts program.

Scott has been awarded with the EY Entrepreneur of the Year 2017 National Award, the Breakthrough Award from the Accessories Council Excellence Awards, named Outstanding Mother of the Year by the Mother’s Day Council, awarded Texas Businesswoman of the Year by the Women’s Chamber of Commerce, listed by Forbes as one of America’s Richest Self-Made Women, listed among the Top 100 Entrepreneurs of the Year by Upstart Business Journal, and named Best CEO by Austin Business Journal. In 2019, Scott was inducted into the Texas Business Hall of Fame. She is a member of the board of directors for the Breast Cancer Research Foundation.

MARIA SHARAPOVA

- Season 11

- Tennis superstar: Five-time Grand Slam winner

- One of the “30 Legends of Women’s Tennis: Past, Present and Future,” Time Magazine

- Founded Sugarpova candy company

- Established the Maria Sharapova Women’s Entrepreneur Program

- Goodwill Ambassador to Chernobyl for the United Nations Development Programme

- World Tennis Association Humanitarian of the Year

Maria started thinking about life after tennis when she was only 21 and sidelined with a serious shoulder injury. Perhaps unusual for an athlete, candy came to mind. But she has an unapologetic sweet tooth, and candy brings back happy childhood memories of Russia when her father rewarded her with a piece of candy after a long day of tennis.

She was undaunted by her lack of experience in growing a business of any kind and particularly a food business. In fact, she says now that her lack of experience was an advantage. She approached the operations with a fresh perspective, a sophisticated one, from her years of traveling around the world. But we can never discount that, contributing to her success in business, is her indomitable competitive spirit.

Maria partnered with candy guru, Jeff Rubin, and founded Sugarpova to produce a premium candy line that offers affordable, guilt-free indulgence. The line consists of 12 varieties of candy, each unique flavor representing the many sides of Maria: chic, flirty, sassy, quirky and sporty.

All Sugarpova confections are made with all-natural ingredients, such as organic cane sugar, fruits, vegetables, sunflower oil and spirulina. Max Eisenbud, Maria’s agent since she was 11, is the CEO, but Maria oversees every aspect of the business, from designing the whimsical kiss logo and the colorful packaging to coming up with fun names, such as Quirky Pink Grapefruit, Flirty Strawberry Cream and Smitten Sour Blue Raspberry to marketing and research and development.

Sugarpova grew into a $20-million business in six years. Maria is already thinking what’s next, hinting that the company could become a total lifestyle brand.

Maria had much to learn in her jump from tennis champion to entrepreneur, and now she shares those lessons through her Women’s Entrepreneur Program. By donating a percentage of Sugarpova sales, Maria supports women-owned businesses by mentoring, providing networking resources and lending out her own team.

In her role as Goodwill Ambassador for the United Nations Development Programme, she has partnered with the UN in providing scholarships for students from Chernobyl-affected areas of Belarus.

Along with other tennis stars and Governor Jeb Bush, she participated in an exhibition in Tampa to raise money for the Florida Hurricane Relief Fund.

KATRINA LAKE

- Season 11

- Founder and CEO, Stitch Fix

- Youngest female founder to ever lead an IPO

- On the Forbes list of America’s Richest Self-Made Women

Stitch Fix is a San Francisco-based subscription service that sends users a “fix,” a curated box of five items of clothing, every two weeks, every three months, as a one-time purchase—whatever the customer prefers. The customer has three days to keep or return the items.

Customers fill out a comprehensive style profile when they join. The profile is then entered into an algorithm. Additional information is gleaned from a customer’s feedback after receiving the boxes. For example, “I looked like a cow in the black and white print.” The personal stylist checks the algorithm-generated clothing suggestions and what has been sent in previous fixes, then chooses the items for the curated box. Sometimes the customer has a special request: “I need something to wear to my ex-husband’s wedding.” Along the way, the stylist builds a personal relationship with her customers.

Katrina never planned a career in fashion. She majored in pre-med at Stanford University, but felt more engaged in her economics courses. After graduating, she went to work for a retail consultant group, found her niche and proceeded on to Harvard Business School to pursue a master’s degree in entrepreneurship.

While still a student, she developed a data-driven styling solution to give online users a personalized shopping experience, testing it with 20 of her friends. It still needed work, but before long, she established Stitch Fix in her cramped apartment. From that humble start, Stitch Fix now has 3,000,000 active customers and $1.2 billion in revenue. It has expanded to plus- size, petite, maternity, premium-brand, men’s and children’s clothing.

Katrina does five or six fixes a week, because she enjoys it, but also because she wants to know first-hand what her 3,000+ stylists are experiencing. For the same reason, she spends time in the warehouses. She is not an “ivory tower” CEO.

She has a business philosophy that may be unique. She has resolved to maintain a workplace where her children would want to work, where she would want them to work, a place with equal opportunities, where they will be judged on their own merits, not subjected to the whims of a particular manager. In line with that philosophy, she facilitates all her employees having a proper work-life balance. She provides 16 weeks of parental leave to all full-time employees, giving them all a great example when she took the 16 weeks herself after the birth of her second child.

Katrina was recently honored for her work with BUILD, a national nonprofit that uses entrepreneurship to ignite the potential of youth in under-resourced communities and equip them for high school, college and career success.

Stitch Fix partners with Goodwill in the Give Back Box initiative. Use your Stitch Fix box to pack up clothing or household goods you want to donate, print out a free shipping label and drop the box off at any Post Office or UPS drop-off location. Your donation will be mailed at no cost to you, and you will receive a receipt for tax purposes.

ANNE WOJCICKI

- Season 11

- Co-founder and CEO of 23andMe, named “Invention of the Year” by Time in 2008

- Named “The Most Daring CEO” in 2013

- Hosted an extravagant fundraising event for Barack Obama with tickets starting at $32,400

- Co-founder of the Breakthrough Prize given for excellence in physics, life sciences and math

Consumers mail a test tube containing their saliva to the company, which analyzes their DNA and reports any risk for more than 240 health conditions, including cystic fibrosis, sickle cell anemia, certain cancers, Alzheimer’s, Parkinson’s, and coeliac disease, as well as information on their ancestry and where their relatives lived around the world.

The company’s goals are two-fold. The first is to give consumers control over their own medical destinies. For example, if a person finds that she is at a high risk for diabetes, she can make lifestyle changes, such as buy a workout DVD and change her diet.

The second goal is to amass genetic information from as many people on the planet as possible. 23andMe has a data set that is the largest in the world, and it has led to the discovery of numerous genes associated with illness.

Anne grew up on the Stanford University campus. Her father was chair of the physics department, her mother a journalism teacher at Palo Alto High School. They fostered independence in their daughters and expected them to do something meaningful with their lives: Anne, Susan (the current CEO of YouTube, previously instrumental in the founding of Google), and Janet, a PhD in anthropology and epidemiology at the University of California, San Francisco, where she researches everything from obesity to HIV.

Anne graduated from Yale University with a BS in Biology, having done molecular biology research at the National Institutes of Health. After graduating, Anne worked on Wall Street for investment funds, analyzing biotechnology companies. She was frustrated that such a wealthy country could neglect the basic medical needs of some of its citizens. She quit Wall Street in 2000, intending to enroll in medical school. Instead, she decided to focus on research. That year, she met Linda Avey and Paul Cusenza. They pitched the idea of a DNA profiling company to Google, which invested $3.9 million.

23andMe does not only indicate predispositions to certain diseases, but it also helps create the drugs that will treat those diseases. In 2018, GSK (formerly GlaxoSmithKline) invested $300 million into 23andMe, and the two companies will collaborate in developing new medications.

Anne understands the importance of an employee-oriented corporate culture. Happy employees are productive employees, and productive employees contribute to the overall success of the company.

One innovative perk Anne has initiated is “Social Integration Thursday.” Everyone in the company, in groups of five, goes out to lunch on the company’s dime. The members of the group are selected at random by a software program. They can get to know each other, understand one another’s work situations and possibly come up with ideas and solutions.

The Brin Wojcicki Foundation, started by Anne and Google co-founder Sergey Brin when they were married, has given hundreds of millions of dollars in grants to non-profits working on education, environmental issues and women’s issues, as well as to the Human Rights Foundation and the Tipping Point Community that seeks to eliminate poverty in Northern California. The bulk of their largess, however, goes to the Michael J. Fox Foundation for Parkinson’s Research.

In her free time, Anne loves nothing better than spending time with her children, Benji and Chloe, and her extended family, walking in the park or simply hanging out.

DANIEL LUBETZKY

- Seasons 11 – 15

- Founder and CEO of PeaceWorks

- Founder and CEO of KIND Healthy Snacks

- Presidential Ambassador for Global Entrepreneurship by President Barack Obama

- Author of The New York Times bestseller

- One of TIME Magazine’s “25 Responsibility Pioneers”

- One of Advertising Age’s “50 Most Creative People”

Daniel was born and raised in Mexico City. When he was 16, he moved with his family to Texas. He was a natural entrepreneur: reselling watches at flea markets and promoting and performing in magic shows while in high school. He received a B.A. in economics and international relations from Trinity University in Texas and studied abroad in Israel, where he became friends with Israelis and Palestinians. His senior thesis expressed his belief that peace could be achieved in conflict regions through joint business ventures.

After earning his J.D. from Stanford Law School in 1993, he had the opportunity to research the feasibility of joint ventures between Arabs and Israelis. During his research in Israel, Daniel discovered a delicious sun-dried tomato product that resulted in PeaceWorks, a “not-ONLY-for-profit”™ corporation pursuing both peace and profit. Tomatoes from Turkey, glass jars from Egypt, olive oil from Palestine and produced in Israel—the sun-dried tomato spread was an effective business model. It was in everyone’s best interests to maintain peaceful relations.

In the early 2000s, Daniel co-founded the PeaceWorks Foundation’s OneVoice Movement—an international grassroots effort that fortifies and promotes the voices of moderate Israelis and Palestinians who want an end to the conflict.

While traveling for PeaceWorks, Lubetzky found a bar with whole nuts and fruit in Australia. That bar was the catalyst for KIND Healthy Snacks, the fastest-growing US snack company ever. The KIND Movement encourages random acts of kindness by individuals and organizations. The KIND Foundation is now financing the $20 million program, Empatico, that will connect school children around the world so that they can get to know each other, celebrate their similarities, appreciate their differences and expand their world views.

Daniel co-founded Maiyet, a company that partners with artisans in developing nations that create unique and luxurious fashions, promotes their self-sufficiency and mentors them as entrepreneurs.

In 2017, Daniel launched a public advocacy organization called Feed the Truth to counteract the food industry’s influence on food policy and public health.

To share his story and leadership philosophy, Daniel wrote Do the KIND Thing: Think Boundlessly, Work Purposefully, Live Passionately. He aspires to reinvent the way people approach business. It is possible to make a profit and make a difference, build a company and build the community, make healthy products and achieve mass distribution.

Daniel spends his free time with his wife Michelle, a physician, and their four children. And he has never lost his love of and talent for magic.

JAMIE SIMINOFF

- Season 10

- Only entrepreneur/contestant to return to the Tank as a Shark

- Sold his invention, Ring, to Amazon for more than $1,000,000,000

- First splurge after the sale: an $8,000 mountain bike

- Donated $1,000,000 worth of home security devices to inner city residents and personally installed them with Shaquille O’Neal

Growing up, Jamie was an inveterate tinkerer. He could usually be found in the garage building things and teaching himself chemical, mechanical, and electrical engineering along the way. After high school, he went to Babson College for a degree in entrepreneurship and found his love of and talent for selling. He made money selling electronics on campus and writing business plans for others.

After graduation, Jamie went back to the garage, but now with hired assistants. Their more successful ventures were the PhoneTag, the world’s first voicemail-to-text company, and Unsubscribe.com, a service that helped email users clean commercial email from their inboxes.

While working in the garage, he would have to stop what he was doing to go answer the doorbell at the front door—oftentimes for nothing important. He wondered why, with all the technology out there, couldn’t the doorbell ring to his phone and he could find out who was at the door before leaving the garage. Also, his wife, Erin, would feel safer when she was home alone and the doorbell rang. That’s how the DoorBot came about. His devastation from walking away from the Tank without a deal was short-lived. As soon as the show aired, his sales soared and investors were knocking at his door. One of those investors was billionaire Richard Branson, who has been a guest shark.

While at the Consumer Electronics Show in Atlanta, Jamie returned to his booth to see NBA-great Shaquille O’Neal waiting to meet the CEO of Ring to tell him how impressed he was with the technology that was providing security for his large home. As soon as Shaq got over the surprise of the CEO of Ring being a “kid,” he offered to be the brand’s spokesperson. Jamie and Shaq have fun in Ring’s TV commercials, but they have made a bigger splash while personally installing home security devices for inner-city residents at no charge. Jamie gave Shaq a million dollars worth of Ring products to give away.

With the sale of Ring to Amazon, Jamie remains CEO but concentrates more on his first love, inventing. The company is at the top of the home security market, producing four different doorbells, several cameras and a home monitoring system. Amazon is also backing Jamie’s mission to create safer neighborhoods.

And now as Jamie comes full circle on Shark Tank, he can fulfill another mission: to give back to other entrepreneurs via the same platform that allowed him to achieve his American dream.

MATT HIGGINS

- Season 10

- Rudy Guilani’s press secretary after 9/11

- Executive VP of New York Jets, major force behind MetLife Stadium

- Vice Chairman of Miami Dolphins for owner Stephen Ross

- Together with Ross, founded RSE Ventures investment firm

Matt is also CEO of RSE Ventures, an investment firm that incubates and invests in companies across sports and entertainment, food and lifestyle, media and marketing, and technology that he co-founded with Stephen. RSE helped build the largest privately owned soccer tournament in the world (International Champions Cup) and was an initial investor in Snapchat. Hundreds of investment opportunities cross his desk every month, and he gets great satisfaction in taking a visionary entrepreneur and providing what he/she needs to build a successful company. It is also important to him to pay it forward to other young people trying to transform their lives as he did.

Matt was born into poverty. He grew up in Queens, New York, and, from an early age, found ways to earn money to help his family make ends meet. When he was 16, he quit school to take care of his ailing mother, while he earned a GED. He later earned a degree in political science and government from Queens College, while being an award-winning investigative reporter for the Queens Tribune. And even later, he worked in a law degree from Fordham while serving as Rudy Guilani’s press secretary handling international media in relation to 9/11.

When the New York Jets called, he answered and served as a VP, spearheading their new stadium and practice facility while remaining COO of the Lower Manhattan Development Corporation formed to rebuild the site of the World Trade Center. From there he headed south and became Vice Chairman of the Miami Dolphins and partners with Stephen Ross in RSE Ventures.

Matt raises money toward research for testicular cancer and autism, due to his bout with the cancer and his daughter being autistic. He was also a founding member of Stephen’s anti-racism RISE (Ross Initiative in Sports for Equality) dedicated to harnessing the unifying power of sports to improve race relations and drive social progress through a unique alliance of professional sports leagues, athletes, educators, media networks and sports professionals.

CHARLES BARKLEY

- Season 10

- Played 16 years in the NBA

- Member of Basketball Hall of Fame

- Won two Gold Medals at Olympics as part of the Dream Team

- Won an Emmy for Outstanding Television Analyst

- Wrote a New York Times Best Seller

Charles started in the NBA with the Philadelphia 76ers in 1984 and retired in 2000 with the Houston Rockets due to a career-ending injury. It says everything about Charles that he was not going to end his career being carried off the court. He returned for one game and scored with his trademark, an offensive rebound and putback, and walked off the court to a standing ovation.

Charles went on to his dream job—being paid to watch basketball. He appears regularly during pregame and halftime shows and special NBA events. He is also part of Inside the NBA, a post-game show that provides recaps and comments on games that day and general NBA news. He won a Sports Emmy Award for “Outstanding Studio Analyst.”

If all that is not enough, he also writes and acts. He and sportswriter Roy S. Johnson collaborated on the autobiographical work, Outrageous. Later, he wrote the best-selling I May Be Wrong, But I Doubt It and Who’s Afraid of a Large Black Man?, a collection of interviews with VIPs in entertainment, sports, business and politics. He has appeared in Suits and Modern Family, played himself in Space Jam and is the voice of an animated version of himself in We Bare Bears.

Charles is part of the Alabama Futures Fund that has invested $25 million into start-ups located in Alabama or willing to relocate to Alabama, his home state. The fund also adds meaningful capital to foster economic growth in the state. He personally invests in the careers of minority scientists and into research to determine what factors lead to bad health choices by poor minorities. He pledged one million dollars to help minority women start Internet and technology businesses.

His charitable efforts are legion, from a million dollars for Hurricane Katrina victims, a million to a Birmingham, Alabama, elementary school and another million to his high school, Leeds, to help students pay for college to paying the college tuition of a busboy he met in a restaurant and paying funeral costs for victims of various tragedies. The Charles Barkley Foundation contributes to cancer research, human rights and refugee organizations and veteran support groups.

ALLI WEBB

- Season 10

- Creative genius behind Drybar, the premier hair salon for blowouts

- Recognized by Fortune as one of the top young businesswomen in the world

- Best-selling author: The Drybar Guide to Good Hair for All

- Dedicated to helping children & families in need, Baby2Baby & Los Angeles Children’s Hospital

Alli mastered hair styling when she was still a kid—she had unruly curly hair to tame. But after high school, she went into the fashion industry. It wasn’t the best fit for her, so she decided she needn’t chose one of her two major interests. She went to beauty school, training with some of the great stylists on the East Coast, and proceeded to do hair at fashion shows. That’s what she was doing when she met her husband, Cameron, moved to California and became a stay-at-home mom. After about five years, she was missing the creative outlet of styling hair and started a small business, Straight-at-Home: a mobile service that provided affordable blowouts at clients’ homes. She and her service were so wildly popular that she soon could not handle the demand. She unwittingly had filled a huge gap in the hair care market. Full-service salons were overcharging for blowouts. Alli charged reasonable prices while retaining the feel of a luxurious experience.

The mobile service was no longer sufficient to meet the demands of her clients. She had to open a shop in which she could stay in one place and have her devoted clients come to her. She enlisted the talents of her husband in branding, advertising and website design and her brother, Michael Landau, in business and growing world-class brands, and the three founded the first Drybar in Brentwood, an affluent neighborhood in Los Angeles. Today, Alli has more than 100 salons that stretch across the country, and she is looking toward Paris. Her product lines and hair-styling tools are sold in Nordstrom, Sephora, and Ulta, and she made the best-seller lists with her book on mastering the perfect blowout.

Alli has been named one of the “100 Most Creative People in Business” by Fast Company and “Most Fascinating Women” by Marie Claire. She was featured on Fortune magazine’s “40 Under 40” list as one of the top young businesswomen in the world. Drybar was named one of the top “100 Brilliant Ideas of 2010” by Entrepreneur magazine and New York Magazine’s “Boom Brands of 2013.”

ROHAN OZA

- Season 9

- Made Vitaminwater and Smartwater household names

- Known as the “Brandfather”

- Beat Tyra Banks in a dance-off

- Founder Idea Merchants Capital

Rohan was born of Indian parents in Zambia, educated in Great Britain and went to graduate school at the University of Michigan. His first position was as manufacturing manager for M&Ms. He told his supervisor that he’d be better in marketing. The supervisor said, in essence, “No, you wouldn’t.” So Rohan quit to pursue an MBA at the University of Michigan. From there, he went to work for Coca-Cola as a marketing manager. Sprite and Powerade sales had slipped dramatically. Rohan reinvigorated the brands by hiring people passionate about the products, redesigning the packaging and enlisting Kobe Bryant as celebrity spokesperson. Sales of Sprite and Powerade soared into the stratosphere.

Regardless of his phenomenal success, Rohan wasn’t comfortable in the corporate culture—a little too “buttoned-down” for his temperament. He resigned to join Glaceau, a $25-million company (compared to Coke’s $70 billion) that was putting vitamins (of all things!) in soft drinks. His colleagues at Coke laughed and wished him luck. It didn’t take long for Rohan to make Vitaminwater and Smartwater household names, and five years after his Coke colleagues laughed, Coke bought Glaceau for $4 billion.

Rohan founded Idea Merchants Capital to invest in products that are healthier than anything currently on the shelves and build them into iconic brands. His successes include Vita Coco; Health-Ade Kombucha (fastest-growing brand of fermented tea); Pop Chips; Bai (antioxidant infusion drinks); and Chef’s Cut Real Jerky.

Rohan has many philanthropic endeavors, but closest to his heart is The Children Matter NGO, a partnership between the Starkey Hearing Foundation and Matter Organization, which provides medical equipment and hearing implants, as well as food and other everyday necessities, to underprivileged children in Africa.

ALEX RODRIGUEZ

- Season 9

- Founder A-Rod Corp investment firm

- Most grand slams in history, member of the 3,000-hit club

- Co-wrote two children’s books, Hit a Grand Slam and Out of the Ballpark

- Emmy winning commentator for Fox Sports

- Signed the largest sports contract ever (at that time)—$275,000,000 for 10 years

Alex was born in New York City in 1975. His family returned to the Dominican Republic when he was 4 and later settled in Miami, where his single mother worked three jobs to provide for her children. He excelled in baseball and football in high school and was offered an athletic scholarship to the University of Miami. He decided to go directly into professional baseball and signed with the Seattle Mariners for a $1,000,000 contract and a $1,000,000 signing bonus.

Less well-known is Alex’s talent for business. He started investing while still in his 20s, establishing A-Rod Corp with the purchase of a single duplex in Miami. He and his hand-picked team of accomplished investment professionals grew the corporation into a fully integrated real estate investment and development firm, later branching out into sports, wellness, media and entertainment ventures. Alex believes in keeping it simple: Invest in companies that you are passionate about and can contribute to over and above the capital.

Alex has a long memory for the people and organizations who helped him. He is dedicated to supporting the Girls and Boys Club, donating $1 million to the Miami-Dade chapter and funding scholarships for Girls and Boys Club alumni to attend the University of Miami. He also remains loyal to UM, donating $4 million to renovate the baseball stadium and $500,000 to the UM School of Business Administration.

In addition to guest-sharking, Alex mentors financially strapped former pro athletes on Back in the Game on CNBC.

SARA BLAKELY

- Season 9

- Founder of Spanx

- Part owner of Atlanta Hawks

- Listed as one of the “100 Most Influential People” by Time Magazine

- Committed to the Giving Pledge

After graduating from Florida State University with a degree in communications, Blakely had planned to study law, but due to low scores on the Law School Admissions Test decided to change direction. She worked for a few months at Disney World and occasionally made appearances as a stand-up comedian. Then she accepted a position with Danka, an office supply company, selling fax machines door to door. Not surprisingly she was good at sales and by 1998 had been promoted to a national sales trainer for Danka.

At 27, Blakely moved to Atlanta, Georgia, and while still working for Danka, spent the next two years and $5,000 in savings developing her prototype. Once she was satisfied with the design, she drove to North Carolina to pitch it to the numerous hosiery mills there. She was turned away again and again and returned to Atlanta. She had learned a (perhaps not so surprising) fact: the hosiery design and manufacturing business was run solely by men who had likely never used the product!!

She might have been discouraged and given up. However, she had internalized a critical lesson from her father. In an article by Melanie Curtin of Inc.com on September 29, 2017, Blakely had described how “…as a child, her father would sit her down at the dining room table and ask her the same question: ‘What did you fail at this week?’ … And when she told him, do you know what his reaction was? He high-fived her.”

Blakely admits, “I didn’t realize at the time how much this advice would define not only my future, but my definition of failure. I have realized as an entrepreneur that so many people don’t pursue their idea because they were scared or afraid of what could happen. My dad taught me that failing simply just leads you to the next great thing.” (Fortune, 10/25/12)

And sure enough, not long after she returned to Atlanta, she got a call from a mill operator in Asheboro, North Carolina, who agreed to work with her, because he had mentioned her design to his daughters who convinced him it was a great idea!

Blakely began to market her product, giving it the slightly racy name of Spanx. She secured a meeting with Neiman Marcus and demonstrated the product by changing in the ladies restroom in front of the Neiman Marcus buyer. (It’s a good guess that her past experience in stand-up comedy came in handy here.) This unconventional demonstration resulted in Spanx being sold in seven Neiman Marcus stores, with Bloomingdale, Saks and Bergdorf soon following.

Blakely decided to send a sample of her products to Oprah, and in November, 2000, Winfrey named Spanx one of her “Favorite Things. Sales skyrocketed and Blakely left Danka to devote full time to her new business. In the first year Spanx achieved $4 million in sales and $10 million during the second year. In 2001, Spanx appeared on QVC and sold 8,000 pairs in the first six minutes.

Since then Spanx has expanded its line to include body suits, bras, and slips, as well as designs for plus sizes, maternity wear, and most recently for men. Spanx are being sold in over 50 countries, and Blakely has attained the distinction of being the first female self-made billionaire.

Not one to rest on her laurels, in 2006 Blakely launched the Sara Blakely Foundation. She has supported The Center for Civic Innovation in Atlanta, The Brameen American Social Business Fund, The Malala Fund, and donated $1 million to the Oprah Winfrey Leadership Academy for Girls. In 2013 she committed to donating at least half of her wealth to philanthropy through the Giving Pledge campaign (started by Bill Gates and Warren Buffett). All of this is to support what she believes is her most important mission: To help women feel great about themselves and their potential.

RICHARD BRANSON

- Season 9

- Founder of the Virgin Group of more than 25 companies

- First “office” was in a church crypt

- World records in boating, ballooning, amphibious vehicle, kite surfing

- First person to fly a balloon over Mount Everest—he had taken a wrong turn

- Knighted by Queen Elizabeth in 1999